Are Irs Deductible Standard Mileage Rates Also For Electric Vehicles Meaning

Are Irs Deductible Standard Mileage Rates Also For Electric Vehicles Meaning. Car expenses and use of the. The actual expenses method, or.

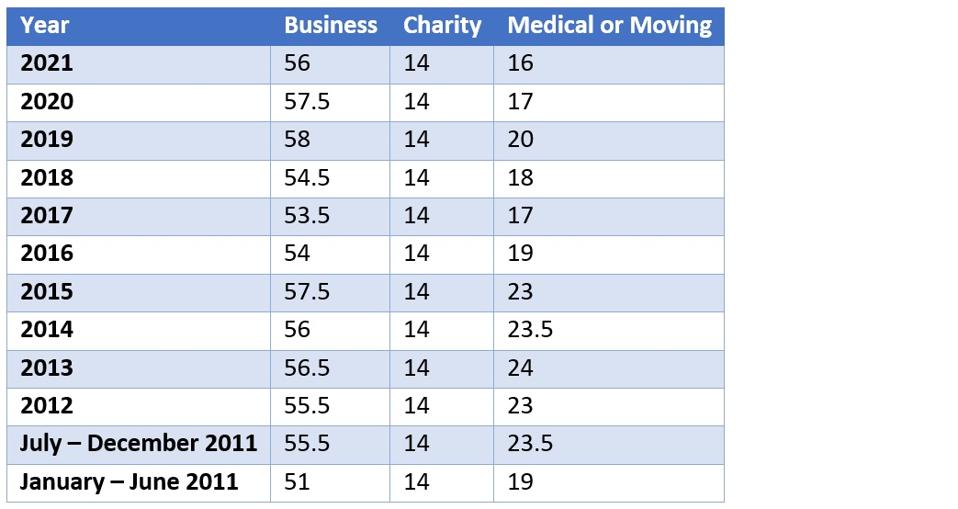

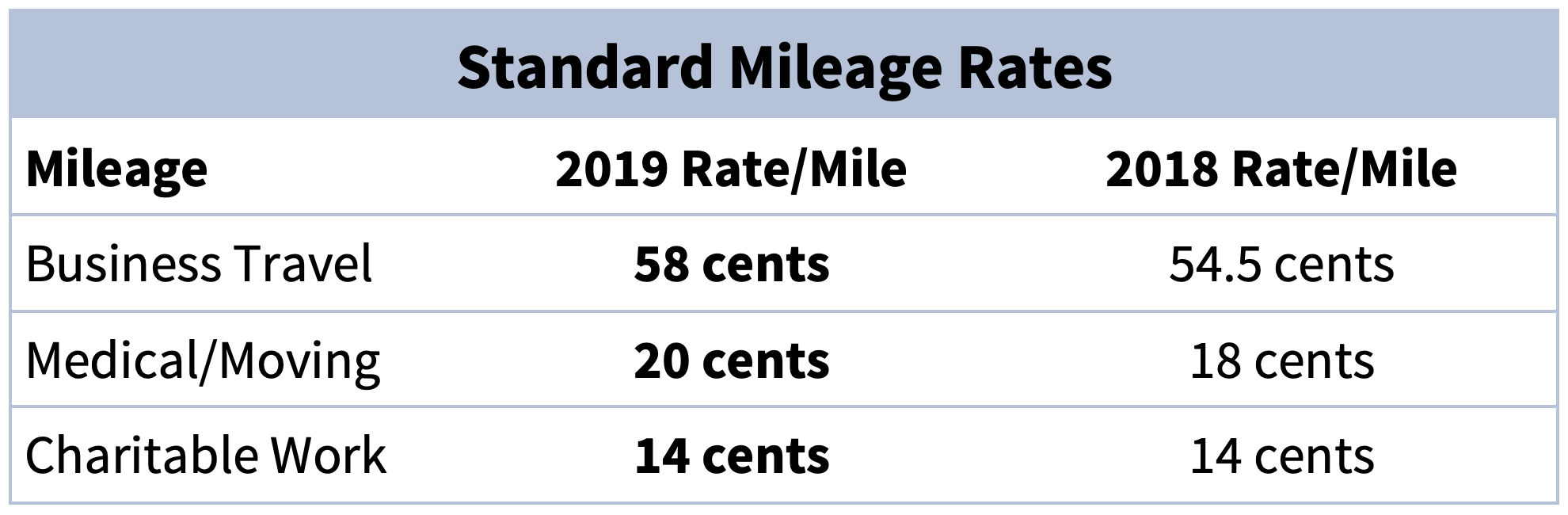

A set rate the irs allows for each mile driven by the taxpayer for business, charitable, medical or moving purposes. The mileage rates exclude expenses related to parking and tolls and are uniform across geographic locations.

Understanding Mileage Rates 2024 Standard Mileage Rates.

For 2023, the irs' standard mileage rates are $0.655 per mile for business, $0.22 per mile for medical or moving, and $0.14 per mile for charity.

Each Method Has Its Advantages And Disadvantages, And They Often Produce Vastly Different.

For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile.

Moving ( Military Only ):

Images References :

Source: financialnations.com

Source: financialnations.com

New 2021 IRS Standard Mileage Rates Financial Nations, Washington — the internal revenue service. In the national taxpayer advocate’s 2023 purple book, i recommended that congress implement consistent standard mileage rates for business, charitable, medical.

Source: expressmileage.com

Source: expressmileage.com

IRS Standard Mileage Rates ExpressMileage, A set rate the irs allows for each mile driven by the taxpayer for business, charitable, medical or moving purposes. The irs annually publishes three standard rates used to calculate deductions for mileage driven for business, medical/moving, and charitable purposes.

Source: www.taxoutreach.org

Source: www.taxoutreach.org

How to Claim the Standard Mileage Deduction Get It Back, 67 cents per mile driven for business use (up 1.5 cents from 2023) 21 cents per mile driven for. How is the standard irs mileage rate determined?

Source: irs-mileage-rate.com

Source: irs-mileage-rate.com

Government Mileage Rates IRS Mileage Rate 2021, Car expenses and use of the. And you can't deduct the cost of the car through depreciation or section 179 expensing because the car's depreciation is also factored into the standard mileage rate (as are.

Source: www.gofar.co

Source: www.gofar.co

Everything You Need to Know About IRS Commuting Mileage Rules GOFAR, The irs annually publishes three standard rates used to calculate deductions for mileage driven for business, medical/moving, and charitable purposes. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile.

Source: zenithconsults.com

Source: zenithconsults.com

The 2020 standard mileage rate, straight from IRS Zenith, The mileage rates exclude expenses related to parking and tolls and are uniform across geographic locations. Key factors affecting ev mileage reimbursement electricity.

Source: hrwatchdog.calchamber.com

Source: hrwatchdog.calchamber.com

IRS Announces 2019 Standard Mileage Rates HRWatchdog, Key factors affecting ev mileage reimbursement electricity. Find out when you can deduct vehicle mileage.

Source: www.zrivo.com

Source: www.zrivo.com

IRS Standard Mileage Rates 2022, Find out when you can deduct vehicle mileage. 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

Source: ar.inspiredpencil.com

Source: ar.inspiredpencil.com

Irs Allowable Mileage Rate 2022, For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

Source: falconexpenses.com

Source: falconexpenses.com

2020 IRS Mileage Reimbursement Rates, Below we’ll break down how tracking business. Mileage reimbursement rates for electric cars in the u.s.

Below We’ll Break Down How Tracking Business.

58.5 cents per mile driven for business use,.

How Is The Standard Irs Mileage Rate Determined?

Assuming the irs standard mileage rate is $0.67 per mile.