Rowan County Property Tax Rate 2024

Rowan County Property Tax Rate 2024. To obtain vehicle tax receipt, log onto mydmv. Reappraisal reestablishes the fairness of the tax burden.

Take a look at the tax rates each year for different areas in the county. The tax rates for each district is set as part of the budget process and takes place no later than june 30 of each year.

What Is The Sales Tax Rate In Rowan County?

Tax rates for fiscal year july 1, 2023 to june 30, 2024.

Residential Prc Commercial Prc Tax Receipt.

County assessors are compelled by the kentucky constitution to set real property market values.

The Minimum Combined 2024 Sales Tax Rate For Rowan County, North Carolina Is.

Images References :

Rowan County, Look up 2024 sales tax rates for rowan county, kentucky. Rowan county property tax rates in 2023.

Source: www.pinterest.com

Source: www.pinterest.com

Historic Map Historical Map, Rowan County in the State of North, This ranks rowan county 53rd of 100 counties in north. 402 n main street suite 101 salisbury, nc 28144.

Source: www.rcky.us

Source: www.rcky.us

Occupational Tax — Rowan County, Kentucky, The revaluation raised rowan county’s property tax base. Tax rates provided by avalara are updated regularly.

Source: sbpta.com

Source: sbpta.com

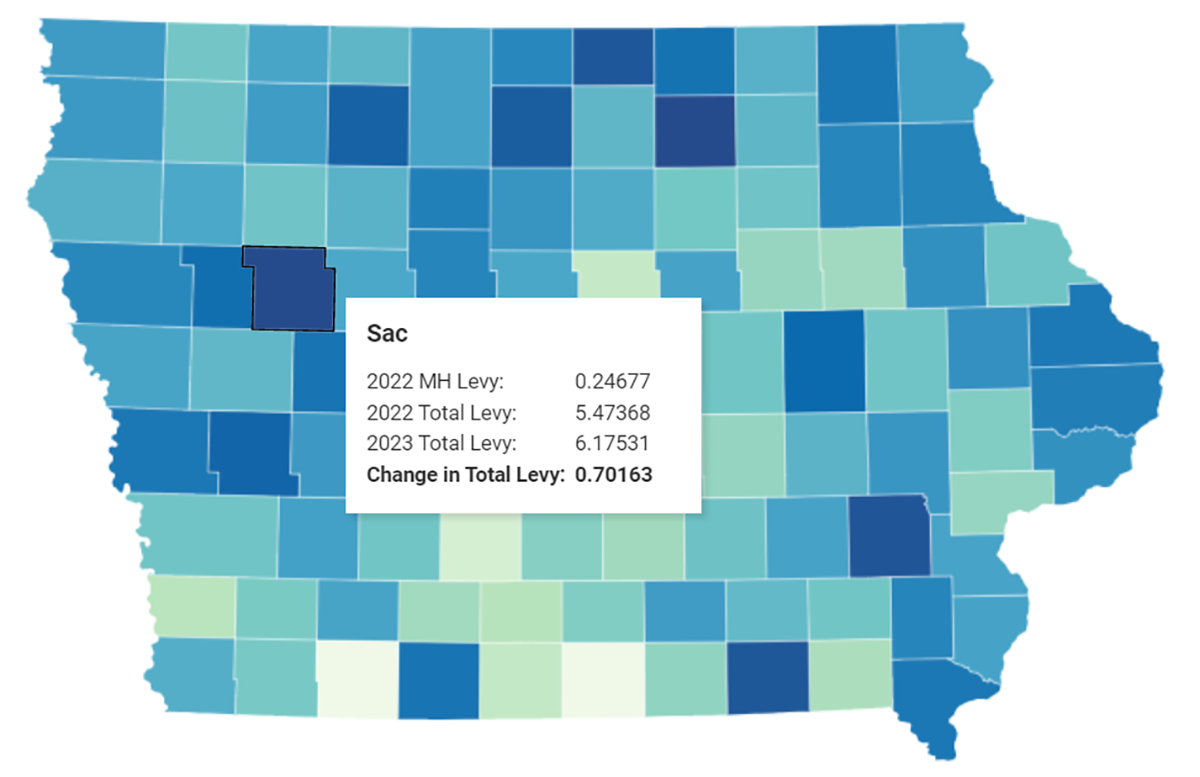

Rowan County Property Tax Rates in 2023 SBPTA, The tax rates for each district is set as part of the budget process and takes place no later than june 30 of each year. There is a returned check fee of $25 or 10% of check (whichever is greater).

Source: www.niche.com

Source: www.niche.com

2021 Best Places to Live in Rowan County, NC Niche, This is the total of state and county sales tax rates. This is the process of updating rowan county’s real property values to reflect fair market value as of january 1, 2023.

Source: www.okhba.org

Source: www.okhba.org

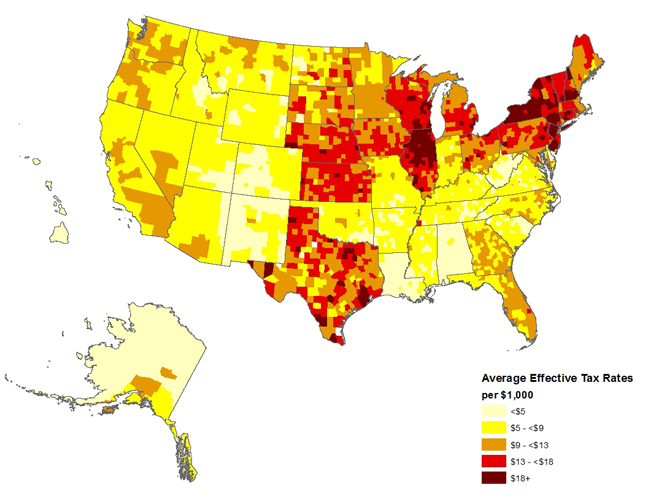

NAHB Now Property tax rates vary across and within counties OkHBA, If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the rowan county tax appraiser's office. Reappraisal reestablishes the fairness of the tax burden.

Source: sbpta.com

Source: sbpta.com

Rowan County Property Tax Rates in 2023 SBPTA, Rowan county has a tax rate of $0.658 per $100 of assessed value. 402 n main street suite 101 salisbury, nc 28144.

Source: staeti.blogspot.com

Source: staeti.blogspot.com

Property Tax Zip Code STAETI, This is the process of updating rowan county’s real property values to reflect fair market value as of january 1, 2023. If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the rowan county tax appraiser's office.

Source: taxfoundation.org

Source: taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation, What is the sales tax rate in rowan county? Each year the citizens of rowan county pay their annual property tax to the county.

Source: taxrelief.org

Source: taxrelief.org

County Property Tax Levy Rates Iowans for Tax Relief, The tax rates for each district is set as part of the budget process and takes place no later than june 30 of each year. This is the process of updating rowan county’s real property values to reflect fair market value as of january 1, 2023.

Residents Can Call The Rowan County Tax Assessor’s Office To Make An Informal Appeal.

The minimum combined 2024 sales tax rate for rowan county, north carolina is.

This Is The Process Of Updating Rowan County’s Real Property Values To Reflect Fair Market Value As Of January 1, 2023.

Take a look at the tax rates each year for different areas in the county.